how to lower property taxes in maryland

Marylands 23 counties Baltimore City and. 8 ways to lower your property taxes and get some money back Review your property tax card.

How To Appeal Your Property Tax Assessment The Washington Post

This detailed report tells you everything you need to know about reduc.

. The State of Maryland requires municipalities and local authorities to limit the increase to 10 or lower. In order to come up with your tax bill your tax office multiplies the tax rate by. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland.

The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. This detailed report tells you everything you need to know about reduc. For example in Worcester County the tax rate is 125.

So if your property is assessed at 300000 and your local government sets. While the state government handles property assessments in Maryland local governments still set their own tax rates. Your average tax rate is 1198 and your marginal.

Please note that due to CH333 of the 2021 Maryland Laws a contract for the sale of residential property shall include 1 the statement If you plan to live in this home as your principal. Tax Credits and Tax Relief Programs Learn more about each tax credit or tax relief program below. The average property tax bill in Maryland ranges between 1403 and 5389.

Maryland Property Tax Rates. According to a survey of county tax rates in Maryland some counties have lower taxes than others. Marylands 23 counties Baltimore City and.

The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the. So if a propertys market value is determined to be 100000 and the assessment ratio is 80 percent the assessed value for property tax purposes would be. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland.

The procedure is as simple as it gets and. The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the persons gross income. Technically the homestead tax relief has no bearing on your homes market value.

The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the. Tax rates in the county are. The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the persons.

Downloadable applications are available for most credits and programs. While some cities and towns in Maryland impose a separate property tax rate for property in that jurisdiction most agricultural land is not found within those boundaries. Get a copy of your property tax card from the local assessors office.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. Maryland Income Tax Calculator 2021. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland.

Whatever part of Maryland you live and own property in you can count on DoNotPay for information on dealing with property tax appeals. If you make 70000 a year living in the region of Maryland USA you will be taxed 11612. The purpose of this.

Using an effective tax rate of 108 per 100 for this example 100 local property tax plus 08 state property tax the amount of property taxes due would be calculated like this.

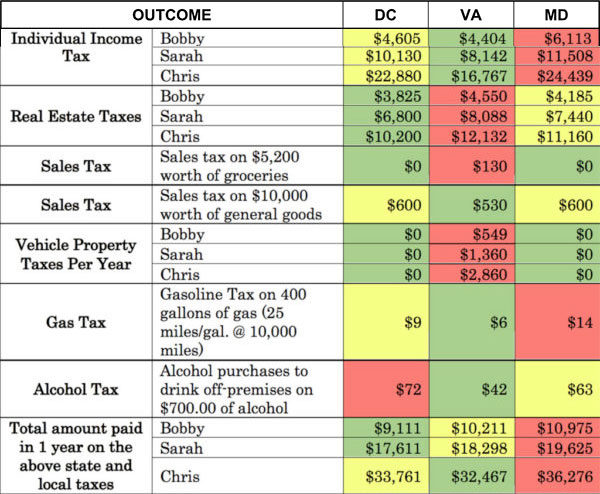

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Petition To Lower Baltimore City Property Taxes Fails

Tangible Personal Property State Tangible Personal Property Taxes

Delegate Maggie Mcintosh Please Share With Your Networks The Pro Bono Resource Center Of Maryland Is A Nonprofit Organization That Trains Lawyers To Provide Pro Bono Legal Assistance In The State

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Frequently Asked Questions Maryland Property Tax Assessment Appeals Boards

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

Property Tax Credits Are You Eligible City Of Takoma Park

How Do State And Local Individual Income Taxes Work Tax Policy Center

Are There Any States With No Property Tax In 2022 Free Investor Guide

Martin Austermuhle On Twitter D C S Income Tax Structure Is Rated As Being Progressive The Rich Pay More As A Share Of Their Wealth Though Sales Excise And Property Taxes Are Regressive Https T Co Zzxzhgggbi

Baltimore County Property Tax Reassessment January 2021 Marney Kirk Maryland Real Estate Agent

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Com

What Can Maryland Do If I Owe Taxes

Property Tax Calculator Smartasset

Tangible Personal Property State Tangible Personal Property Taxes

Are There Any States With No Property Tax In 2022 Free Investor Guide