are taxes cheaper in arizona than california

66 Property tax per capita. I just checked and according to the tax Foundation Arizona has the second highest taxes by combining state and sales tax.

Moving From California To Nevada Or Arizona Which Is Better Rpa Wealth Management

Arizonas state sales tax is 56.

. Cost of Living Indexes. Arizona individual income tax rate is 454 while Californians need to pay 93. Are taxes cheaper in Arizona.

Arizona individual income tax rate is 454 while Californians need to pay 93. According to Bloomberg Arizona taxes are much lower than California taxes. The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homesThe average effective tax rate in the state is 062 which is well below the 107 national average.

Between the tax relief and lower cost of living we are economically much better off than when we were in CA. Single or married filing separately and gross income GI is greater than 12400. How much money do you need to retire in Arizona.

CA has some of the highest taxes in the Nation personal income tax rates are roughly double of AZs and Gas taxes are higher also But you do get more benefits. Is Arizona a cheap place to live. Income Tax Rates In 2022 single taxpayers with incomes of up to 27272 in Arizona will see a 255 income tax rate while those earning more than that will have to pay 298.

Married and filing jointly and GI is greater than 24800. State sale tax is also lower in Arizona being 660 in comparison with 725 in California. While the range for the state income tax in California has 10 income brackets.

State sale tax is also lower in Arizona being 660 in comparison with 725 in California. Its effective property tax rate is 247 not much higher than the 227 in Illinois. Taxes in Arizona City Arizona are 129 cheaper than California City California.

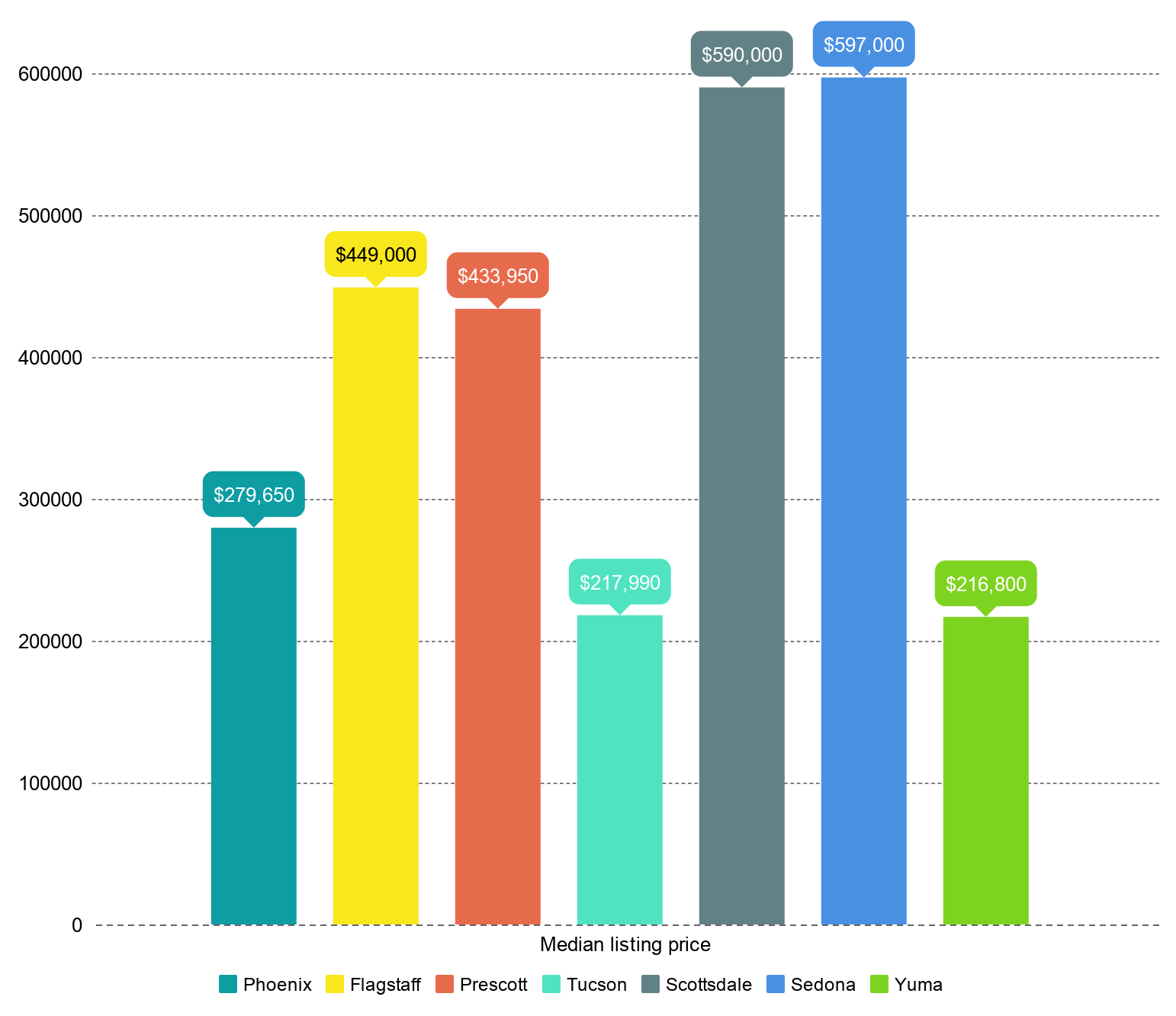

So in addition to getting a ton more house for your money in Arizona if you move to Arizona youll save a ton on taxes each and every year you live here. 52 rows Instead it relies more on property taxes which arent based on a taxpayers income. Im wondering why people tell me its cheaper for me to live in Sun City than California.

For Californians you can really see the difference in our California vs Nevada Tax Guide. The fact that New Hampshire doesnt have an income tax on wages isnt good for the average taxpayer. Arizona is 177 cheaper than California.

In the state of Arizona full-year resident or part-year resident individuals must file a tax return if they are. In December we moved form CA to AZ and have not looked back. So if youre a middle-income person youll pay a smaller portion of your income in state and local tax in Massachusetts than in New Hampshire.

A permanent reduction of Colorados flat individual and corporate income tax rates changed it from 463 to 455. Arizona and Nevada both offer great entertainment options for outdoor lovers. Are taxes cheaper in Arizona than California.

I know the property taxes are cheaper in Sun City but Im wondering what other things people are talking about. Homeowner No Child care Taxes Not Considered. The largest city in Arizona is Phoenix and it has professional sporting teams restaurants museums and art galleries.

In Arizona State the statewide sales tax is 56 and the local taxes have an average of about 84. From Bloombergs look at state taxes. New Hampshire rounds up the list of the top three states with the highest property tax.

If you lived in Arizona instead of California you would. An individual income tax surcharge of 35 was put in effect for taxpayers with marginal income above 250000 single filers or 500000 joint filers. New Hampshires effective tax rate is 218 with Connecticut the only other state with a property tax of over 2 214.

California Income Taxes are Twice as Much as Arizona Income Taxes. Sales Tax State Local Sales. Head of household and GI is greater than 18550.

537300 1552 more Utilities. None The tax burden in Arizona is small compared to that of other states because of its lower-than-average property taxes so the decline in home prices has hit Arizonas municipalities harder than those in many. Top rate dropped from 66 to 59.

Especially for those moving to high-tax states such as California New York or Illinois Nevada is a good choice to stretch your retirement dollar. In California single tax filers earning up to 9326 will pay 1 those earning between 9326 and 22107 pay 9325 plus 2 of the amount over the minimum and those earning. Cost of Living in Arizona vs Nevada.

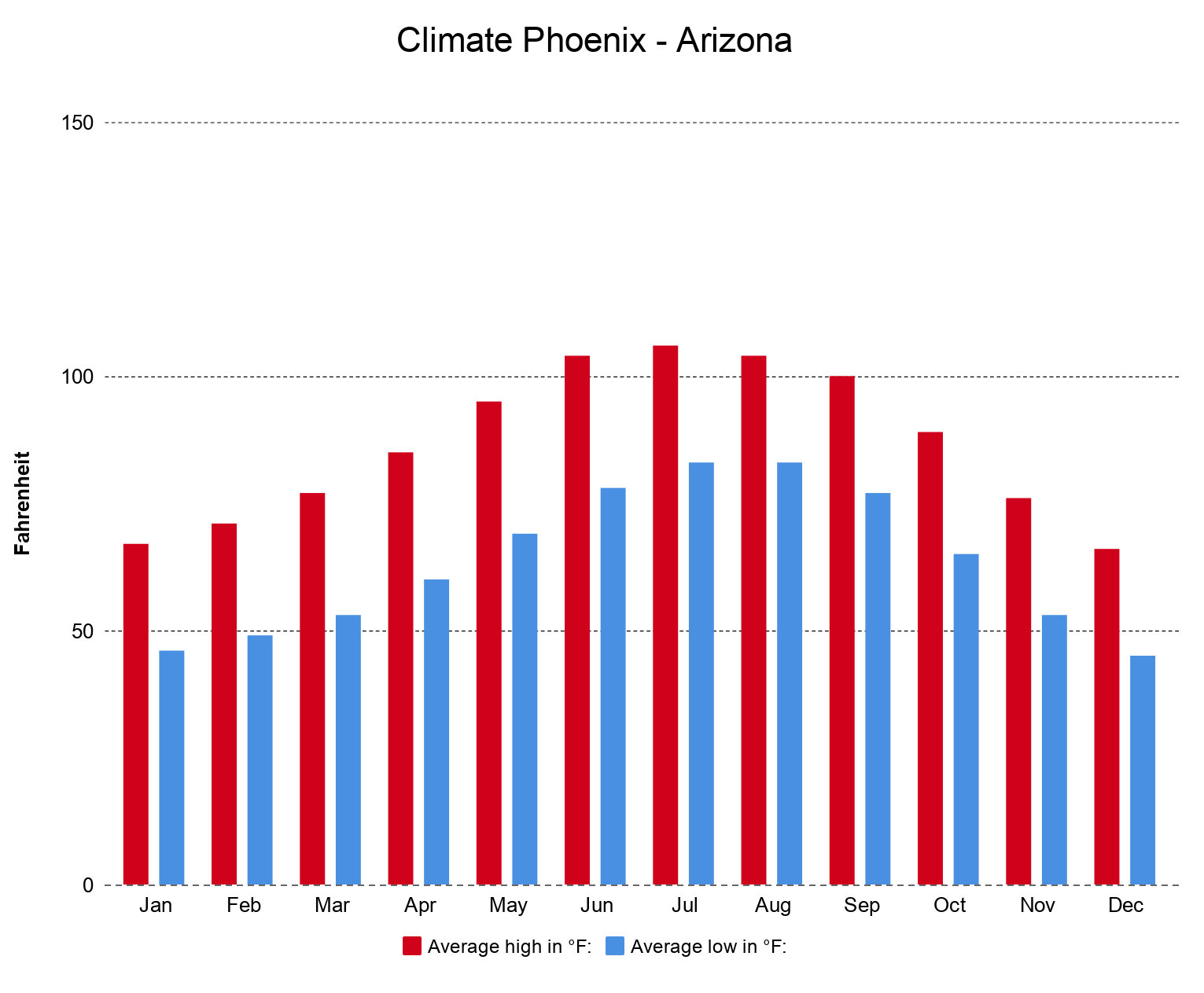

Are taxes cheaper in Arizona than California. This clearly implies that the state income tax of Arizona is lesser than that of California. If you hate the beach you might find Arizona and Nevada to be more attractive than Southern California.

But because localities can add their own sales taxes you could pay as much as 56 more in sales tax.

Pros And Cons Of Moving From California To Arizona State To State Long Distance Movers

Living In Arizona Versus California Living In Phoenix Az

Living In Arizona Versus California Living In Phoenix Az

Living In California Vs Living In Arizona Az Vs Ca Youtube

Moving From California To Arizona Benefits Cost How To

Living In Arizona Versus California Living In Phoenix Az

Pros And Cons Of Moving From California To Arizona State To State Long Distance Movers

Living In Arizona Versus California Living In Phoenix Az

Living In Arizona Versus California Living In Phoenix Az

State Income Tax Rates Highest Lowest 2021 Changes

Is Arizona On The Same Time As California Quora

Living In California Vs Living In Arizona Youtube

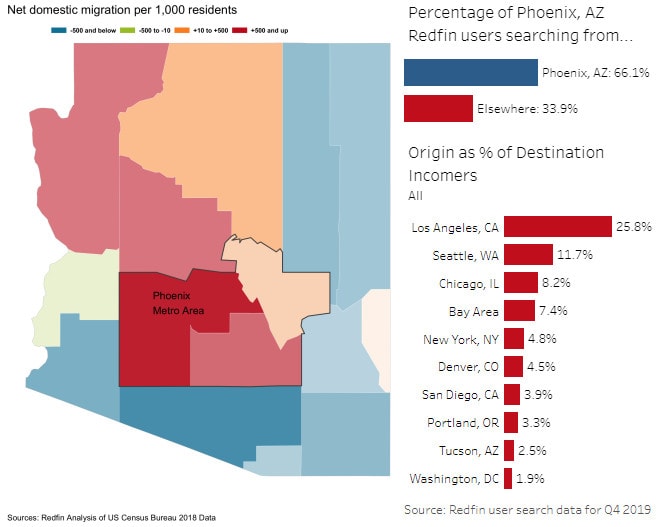

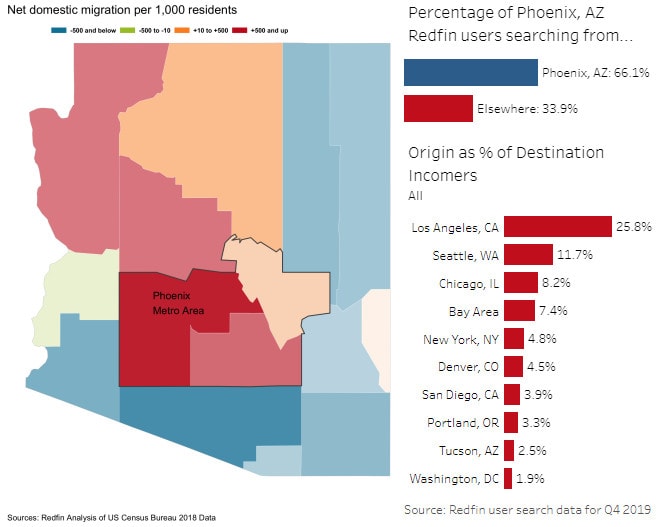

Arizona Amasses Californians And The Political Climate Is Changing

Pros And Cons Of Moving From California To Arizona State To State Long Distance Movers

Cost Of Living In Texas Vs California What S The Difference

Pros And Cons Of Moving From California To Arizona State To State Long Distance Movers

Pros And Cons Of Moving From California To Arizona State To State Long Distance Movers

Pros And Cons Of Moving From California To Arizona State To State Long Distance Movers